:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg) Best Tips on Term Life Insurance vs Whole Life: Which Is Better for Beginners?

Best Tips on Term Life Insurance vs Whole Life: Which Is Better for Beginners?

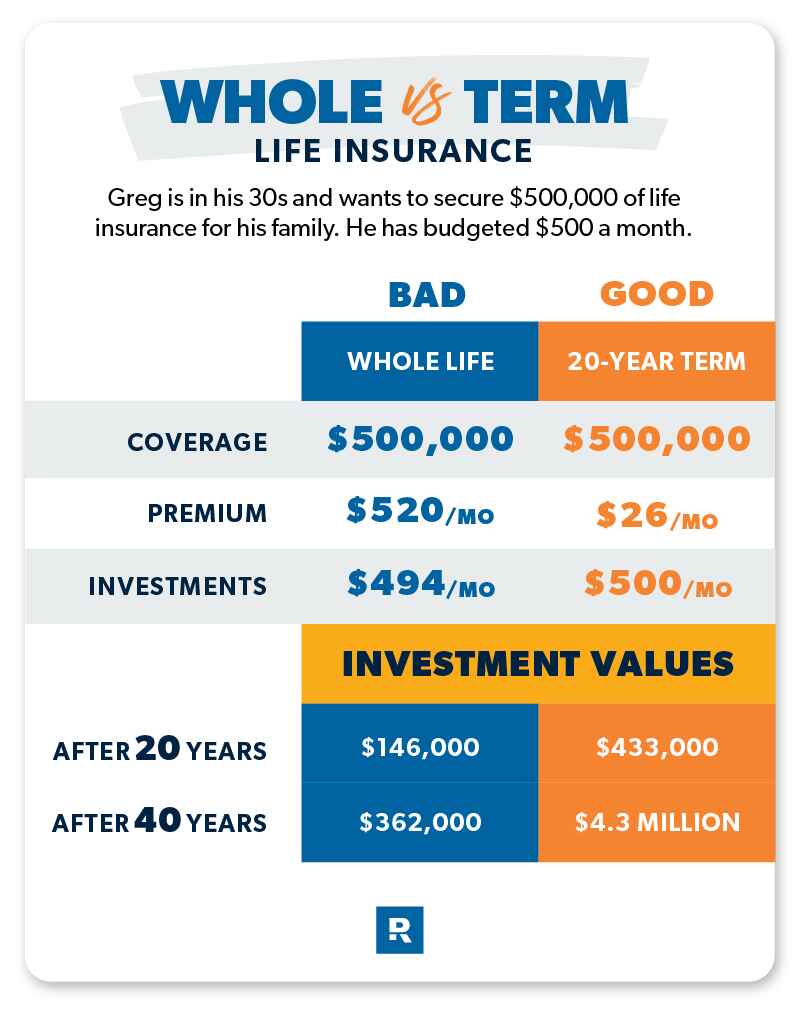

Choosing the right life insurance policy can be a daunting task, especially for beginners. Two popular options are term life insurance and whole life insurance. Both offer financial protection for your loved ones in case of your passing, but they differ significantly in their features, benefits, and costs.

Understanding Term Life Insurance vs. Whole Life Insurance

Term Life Insurance

* **Definition:** Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years.

* **Cost:** It is typically the most affordable life insurance option, especially for younger individuals.

* **Benefits:** It provides a death benefit to your beneficiaries if you pass away during the term of the policy.

* **Drawbacks:** Coverage ends at the end of the term, and there’s no cash value accumulation.

Whole Life Insurance

* **Definition:** Whole life insurance offers lifetime coverage, meaning it remains in effect as long as you pay the premiums.

* **Cost:** It’s generally more expensive than term life insurance due to its lifetime coverage and cash value component.

* **Benefits:** It provides a death benefit and accumulates cash value that can be borrowed against or withdrawn.

* **Drawbacks:** Higher premiums and potentially limited death benefit compared to term life insurance.

Which Type of Life Insurance Is Better?

The best type of life insurance for you depends on your individual needs and financial situation. Here’s a breakdown to help you decide:

**Term Life Insurance is a good option if:**

* You have a limited budget and need temporary coverage for a specific period (e.g., during child-rearing years or while paying off a mortgage).

* You prioritize affordability and want the most coverage for your premium dollars.

* You’re primarily focused on providing a death benefit to your beneficiaries in case of your passing.

**Whole Life Insurance is a good option if:**

* You want lifetime coverage and the potential to build cash value.

* You’re looking for a combination of death benefit and savings component.

* You have a higher risk tolerance and are willing to pay higher premiums for long-term coverage.

FAQs

1. How long does term life insurance last?

Term life insurance policies are typically offered for 10, 20, or 30 years, but some may offer shorter or longer terms.

2. Does term life insurance have cash value?

No, term life insurance does not have cash value. It only provides a death benefit if you pass away during the term of the policy.

3. Can I convert my term life insurance policy to whole life?

Yes, many term life insurance policies offer a conversion option, allowing you to switch to a permanent policy (like whole life) within a specific timeframe.

4. What is the difference between term life insurance and whole life insurance?

Term life insurance provides temporary coverage for a specific period, while whole life insurance offers lifetime coverage and accumulates cash value.

5. Can I withdraw from my whole life insurance policy’s cash value?

Yes, you can withdraw from the cash value of your whole life insurance policy, but withdrawals will reduce the policy’s death benefit and may be subject to taxes and penalties.

Tips for Choosing the Right Life Insurance

1. **Assess your needs:** Determine your financial goals and how much coverage you need to protect your loved ones.

2. **Consider your budget:** Set a realistic budget for your life insurance premiums.

3. **Compare quotes:** Obtain quotes from multiple insurers to compare prices and policy features.

4. **Seek professional advice:** Consult a financial advisor or insurance broker for personalized guidance.

5. **Read the fine print:** Carefully review the policy documents and understand the terms and conditions.

Conclusion

Ultimately, choosing between term life insurance and whole life insurance is a personal decision based on your circumstances and priorities. Term life insurance is a cost-effective option for temporary coverage, while whole life insurance provides lifetime protection and cash value accumulation. By understanding the pros and cons of each type, you can make an informed decision that meets your financial needs. Remember to consult with a qualified professional for personalized guidance and advice.