Ultimate Guide to Credit cards with 0% apr introductory offers in 2024

“`html

Essential Advice for Credit Cards with 0% APR Introductory Offers for Beginners

Essential Advice for Credit Cards with 0% APR Introductory Offers for Beginners

Credit cards with 0% APR introductory offers are a type of credit card that allows cardholders to make purchases and pay no interest for a specific period, typically ranging from six months to eighteen months. These offers are designed to entice new customers and are often accompanied by other incentives, such as bonus rewards or cash back. During the introductory period, cardholders only need to pay the minimum monthly payment, which can significantly reduce the cost of borrowing. However, it is crucial to understand that once the introductory period ends, the standard APR, which can be significantly higher, will apply.

These credit cards can be a powerful tool for managing debt and financing large purchases. They can help individuals avoid paying interest on purchases like home renovations, medical expenses, or travel, providing much-needed financial flexibility. Historically, these offers have been popular among consumers seeking to consolidate high-interest debt or finance large purchases without accruing interest. However, it is essential to use these offers responsibly to avoid accruing significant debt once the introductory period concludes.

This article will delve into the crucial details of 0% APR introductory offers, offering a comprehensive guide for beginners looking to utilize these offers wisely. We will cover common concerns, provide practical tips, and explore the benefits and potential pitfalls of these offers.

FAQs about Credit Cards with 0% APR Introductory Offers

Understanding the mechanics of 0% APR introductory offers is essential before utilizing them. The following FAQs will address some common questions and concerns about these offers.

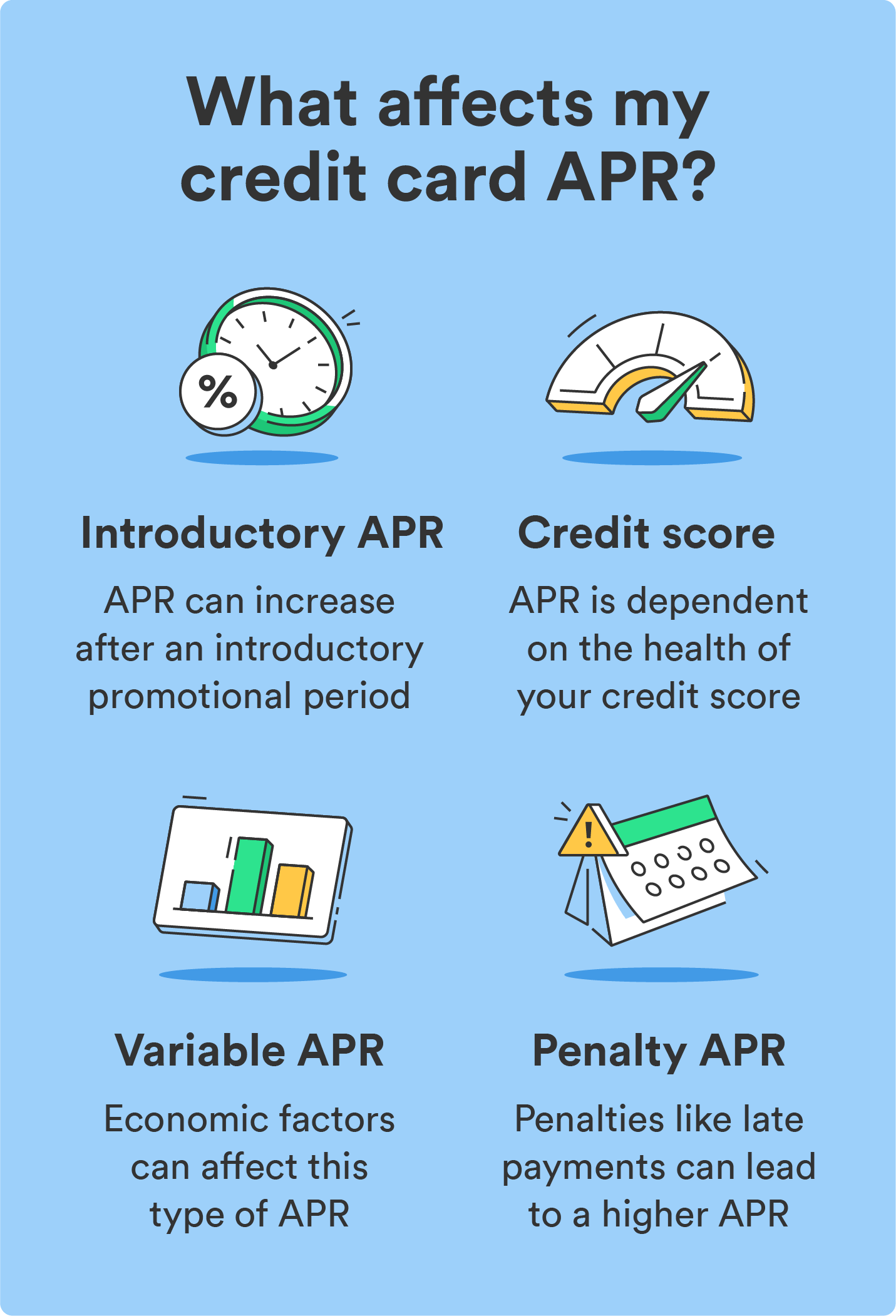

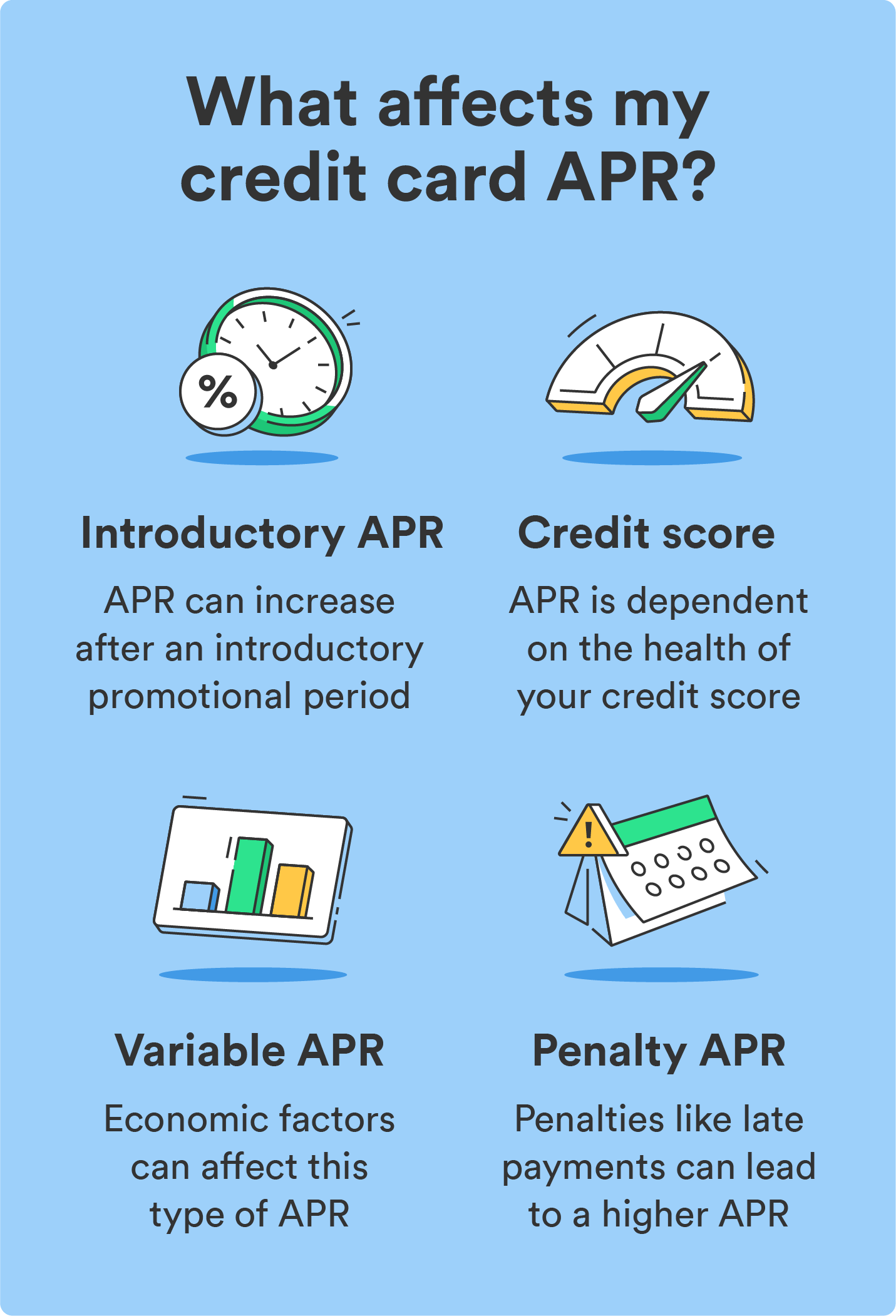

Question 1: What is the standard APR after the introductory period ends?

The standard APR after the introductory period ends varies greatly between credit card issuers and can be significantly higher than the introductory rate. It is crucial to review the terms and conditions of the card before applying to understand the standard APR. This information is typically displayed prominently on the card’s website or within the application process.

Question 2: What are the potential downsides to using 0% APR introductory offers?

While these offers can be advantageous, it is vital to be mindful of the potential downsides. These offers often have strict eligibility criteria, and meeting these requirements may be challenging for individuals with limited credit history or poor credit scores. Additionally, if the balance is not paid in full before the introductory period ends, the standard APR will apply, leading to significant interest charges.

Question 3: How can I find the best 0% APR introductory offers available?

Numerous online resources and comparison websites dedicated to credit cards exist. These platforms allow you to compare various offers based on APR, introductory period, rewards, and other criteria. It is essential to compare several offers before choosing the best card for your needs. Researching credit card offers is crucial to finding the most suitable option for your financial situation and spending habits.

Question 4: Can I transfer existing credit card balances to a 0% APR introductory offer card?

Many credit cards with 0% APR introductory offers allow balance transfers from other cards. This strategy can be beneficial for individuals with high-interest debt, allowing them to pay down their debt at a lower interest rate during the introductory period. However, balance transfer fees usually apply, so it’s crucial to consider these costs when evaluating the overall cost-effectiveness of this strategy.

Question 5: How do I ensure I pay off the balance before the introductory period ends?

Creating a budget that accounts for the minimum monthly payments and setting a realistic plan to pay down the balance fully before the introductory period ends is essential. Consider creating a repayment schedule, which can help maintain focus on paying off the balance and prevent accumulating high interest charges.

Question 6: What are some common mistakes to avoid when using 0% APR introductory offers?

Common mistakes include not understanding the terms and conditions of the offer, neglecting to make payments on time, and overspending during the introductory period. It is crucial to read the fine print, make all payments on time, and use these offers for planned expenses rather than impulsive purchases to avoid accruing debt and interest charges.

Understanding these frequently asked questions provides a valuable foundation for utilizing 0% APR introductory offers effectively.

Tips for Credit Cards with 0% APR Introductory Offers

Utilizing these offers effectively requires responsible planning and execution. The following tips offer valuable insights into maximizing the benefits of these offers.

Tip 1: Set a clear repayment plan: Develop a repayment strategy that prioritizes paying off the balance before the introductory period ends. This plan should include the minimum monthly payments and a timeline for paying down the balance. Establishing a clear repayment strategy will help you avoid accruing interest and stay on track with your debt management goals.

Tip 2: Make sure you qualify: Before applying, ensure you meet the eligibility criteria for the card. Pay attention to credit score requirements and income levels, as failing to meet these requirements could lead to rejection and potentially affect your credit score. Evaluate your current financial situation and credit history before applying to increase your chances of approval.

Tip 3: Compare offers: Research and compare offers from various credit card providers. Utilize online credit card comparison websites to analyze APR, introductory period, rewards programs, and other benefits. This comparison process allows you to identify the offer that best aligns with your needs and financial situation.

Tip 4: Avoid overspending: Resist the temptation to overspend during the introductory period. Limit your purchases to essential items and plan your expenses carefully. Overspending can quickly lead to debt accumulation, negating the benefits of the 0% APR introductory offer.

Tip 5: Utilize balance transfers carefully: If using these offers for balance transfers, ensure you understand the associated fees. Consider the balance transfer fee compared to the potential savings on interest during the introductory period. Only transfer balances from high-interest cards to ensure the balance transfer is cost-effective.

Tip 6: Monitor your spending: Regularly review your credit card statement and monitor your spending. This vigilance can prevent overspending and ensure you stay within your budget. Tracking your spending helps identify areas for improvement and ensures you remain on track with your repayment plan.

Tip 7: Set reminders: Mark the end date of the introductory period on your calendar to avoid overlooking the impending standard APR rate. Setting reminders will help you prepare for the upcoming change in interest rates and plan accordingly.

Following these tips can help maximize the benefits of these offers and minimize the risk of accruing debt and high interest charges.

Conclusion on Credit Cards with 0% APR Introductory Offers

Credit cards with 0% APR introductory offers can be valuable financial tools when used responsibly. They provide a window of opportunity for managing debt and making large purchases without incurring interest. Understanding the terms and conditions, setting a clear repayment plan, and practicing responsible spending are essential to utilizing these offers effectively.

While these offers can provide short-term financial relief, it is crucial to remember that the standard APR will eventually apply. Therefore, planning for this transition is essential to avoid accumulating high interest charges and managing debt efficiently. By utilizing these offers strategically and responsibly, individuals can take advantage of their benefits without incurring significant debt.

“`

Published on: 2024-10-12 11:05:09