Essential Advice for Comparison of fixed-rate vs variable-rate loans for Experts

.png?format=1500w) Best Tips on Comparison of Fixed-Rate vs Variable-Rate Loans for Beginners

Best Tips on Comparison of Fixed-Rate vs Variable-Rate Loans for Beginners

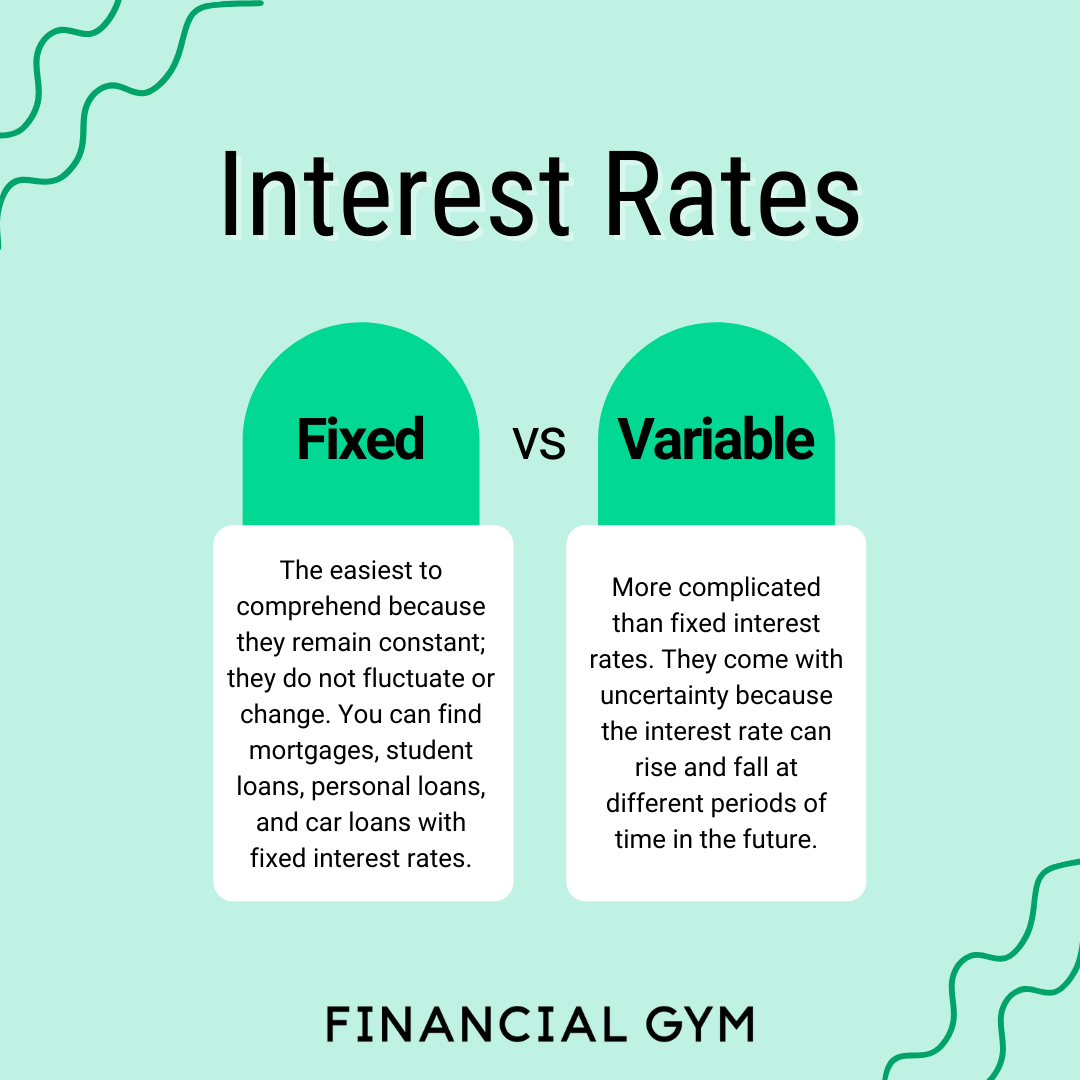

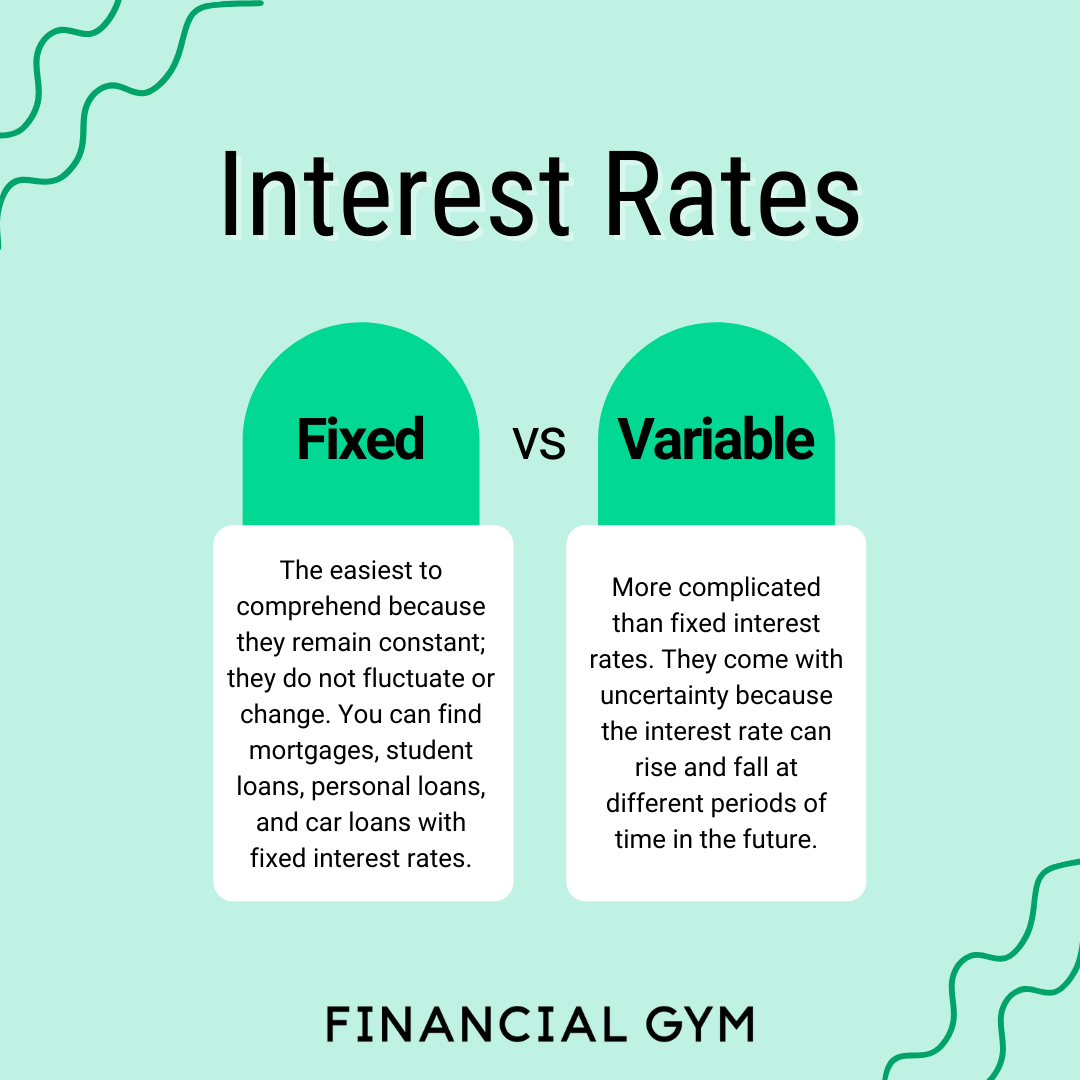

Understanding the differences between fixed-rate and variable-rate loans is crucial for borrowers, particularly those new to the lending landscape. Both options present unique advantages and drawbacks, and a thorough comparison is essential to select the best loan type for individual circumstances.

Fixed-rate loans, as the name suggests, maintain a consistent interest rate throughout the loan term. This predictability offers peace of mind, knowing monthly payments will remain stable regardless of broader economic fluctuations. Conversely, variable-rate loans feature interest rates that fluctuate based on a predetermined benchmark, such as the prime rate or a specific index. This dynamic nature can result in lower initial interest rates compared to fixed-rate counterparts, potentially saving on early payments. However, it also carries the risk of increasing interest rates during the loan term, potentially leading to higher overall costs.

The historical context surrounding fixed-rate vs variable-rate loans is vital for understanding their current relevance. During periods of economic uncertainty, fixed-rate loans tend to be more popular due to their stability, while variable-rate loans might appeal during periods of low interest rates, potentially offering cost savings. Both options have their place, and the ideal choice depends on individual circumstances and financial goals.

FAQs about “Comparison of Fixed-Rate vs Variable-Rate Loans”

This section aims to address common questions and concerns related to fixed-rate and variable-rate loans, shedding light on key considerations for informed decision-making.

Question 1: What is the main difference between fixed-rate and variable-rate loans?

Answer: Fixed-rate loans feature a consistent interest rate throughout the loan term, providing predictable monthly payments. Conversely, variable-rate loans have an interest rate that fluctuates based on a predetermined benchmark, which can lead to lower initial rates but also potential increases in interest payments over time.

Question 2: When is a fixed-rate loan a better option?

Answer: Fixed-rate loans are advantageous for borrowers seeking predictable monthly payments and protection from rising interest rates. They are suitable for those who prioritize stability and want to budget confidently for the loan term.

Question 3: When is a variable-rate loan a better option?

Answer: Variable-rate loans may be beneficial when interest rates are expected to remain low or decrease. They can offer initial cost savings compared to fixed-rate loans, potentially making them attractive for short-term loans or borrowers with a shorter loan term.

Question 4: What are the risks associated with variable-rate loans?

Answer: Variable-rate loans carry the risk of increasing interest rates, leading to higher monthly payments. This can be challenging for borrowers who rely on a fixed budget. They also come with less predictability and potential for higher overall loan costs.

Question 5: Can I switch from a variable-rate loan to a fixed-rate loan?

Answer: In some cases, it may be possible to refinance a variable-rate loan into a fixed-rate loan, but specific options and eligibility criteria will vary depending on the lender and loan terms.

Question 6: What factors should I consider when choosing between a fixed-rate and variable-rate loan?

Answer: Factors to consider include: the expected direction of interest rates, your personal financial goals, your risk tolerance, the length of the loan term, and your ability to handle potential fluctuations in monthly payments.

These FAQs provide a foundation for understanding the key differences and considerations associated with fixed-rate and variable-rate loans.

Tips for “Comparison of Fixed-Rate vs Variable-Rate Loans”

To make informed decisions about fixed-rate vs variable-rate loans, borrowers can employ practical tips and strategies that empower them to make choices aligned with their financial goals and risk tolerance.

Tip 1: Assess your financial goals and risk tolerance. Consider the level of stability you desire in your monthly payments and your ability to handle potential fluctuations in interest rates.

Tip 2: Research current interest rates and historical trends. Understanding the current market conditions and potential future interest rate movements can inform your decision.

Tip 3: Compare loan terms and conditions from multiple lenders. This includes interest rates, loan fees, repayment schedules, and any potential penalties associated with early repayment.

Tip 4: Consult with a financial advisor for personalized guidance. A professional can help you analyze your financial situation, identify your specific needs, and explore the most appropriate loan option for your circumstances.

Tip 5: Consider the length of the loan term. For shorter loan terms, the potential difference in interest rates between fixed and variable rates might be less significant.

Tip 6: Understand the impact of potential interest rate changes. Calculate how much your monthly payments could increase if interest rates rise with a variable-rate loan.

Tip 7: Explore alternative loan options. Depending on your needs, you may find other loan types, such as adjustable-rate mortgages (ARMs) with fixed-rate periods, that could provide a balance between stability and potential cost savings.

These tips provide practical insights into navigating the fixed-rate vs variable-rate loan landscape. By employing these strategies, borrowers can make well-informed decisions and secure loans that align with their financial priorities and risk profiles.

Conclusion on “Comparison of Fixed-Rate vs Variable-Rate Loans”

The choice between fixed-rate and variable-rate loans is not one-size-fits-all. A thorough understanding of each loan type’s characteristics, coupled with personal financial goals and risk tolerance, is crucial for making informed decisions. By leveraging the tips and insights discussed in this article, borrowers can navigate the lending landscape effectively, selecting loan options that support their financial well-being.

Ultimately, the best loan type depends on individual circumstances and financial goals. While fixed-rate loans offer stability and predictable payments, variable-rate loans can provide potential initial cost savings. By engaging in proactive research, seeking professional advice, and considering your unique financial needs, you can empower yourself to make sound financial decisions and navigate the loan market with confidence.

“`

.png?format=1500w)

Published on: 2024-10-12 19:09:42

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas