Essential Advice for Importance of life insurance for family protection You Need to Know

“`html

Top Strategies for Importance of Life Insurance for Family Protection You Need to Know

Top Strategies for Importance of Life Insurance for Family Protection You Need to Know

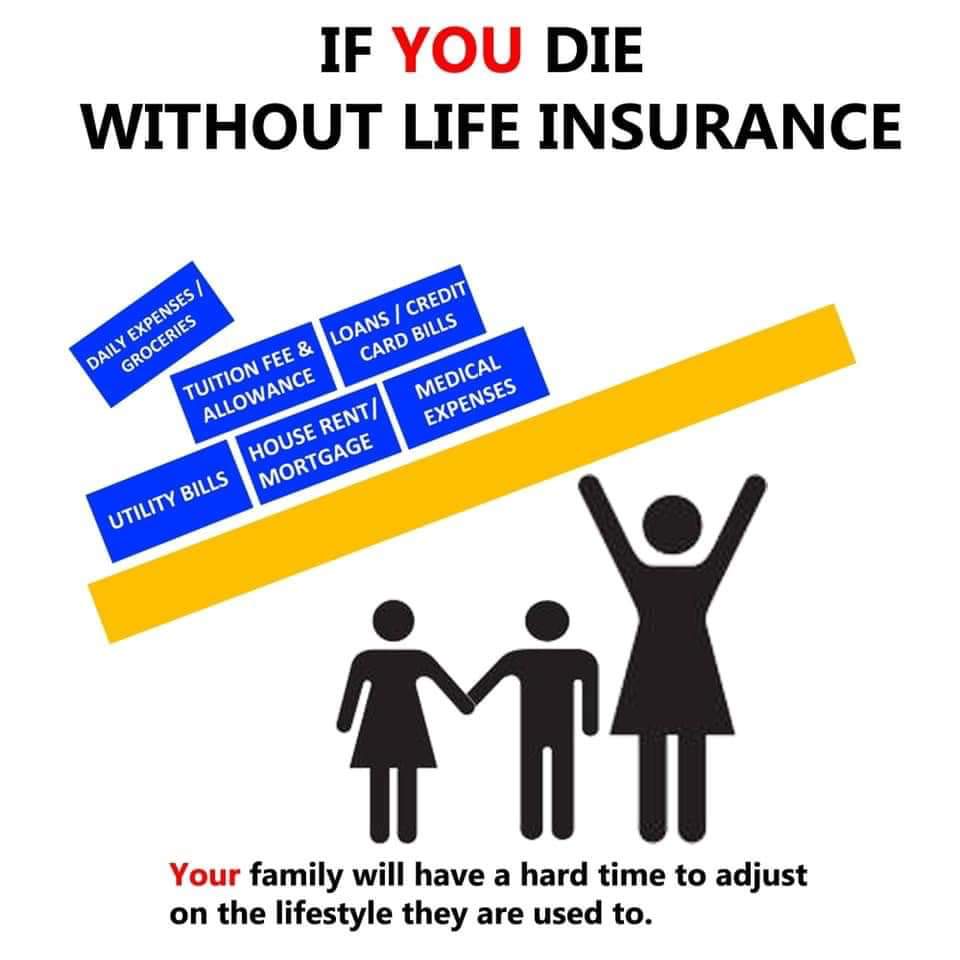

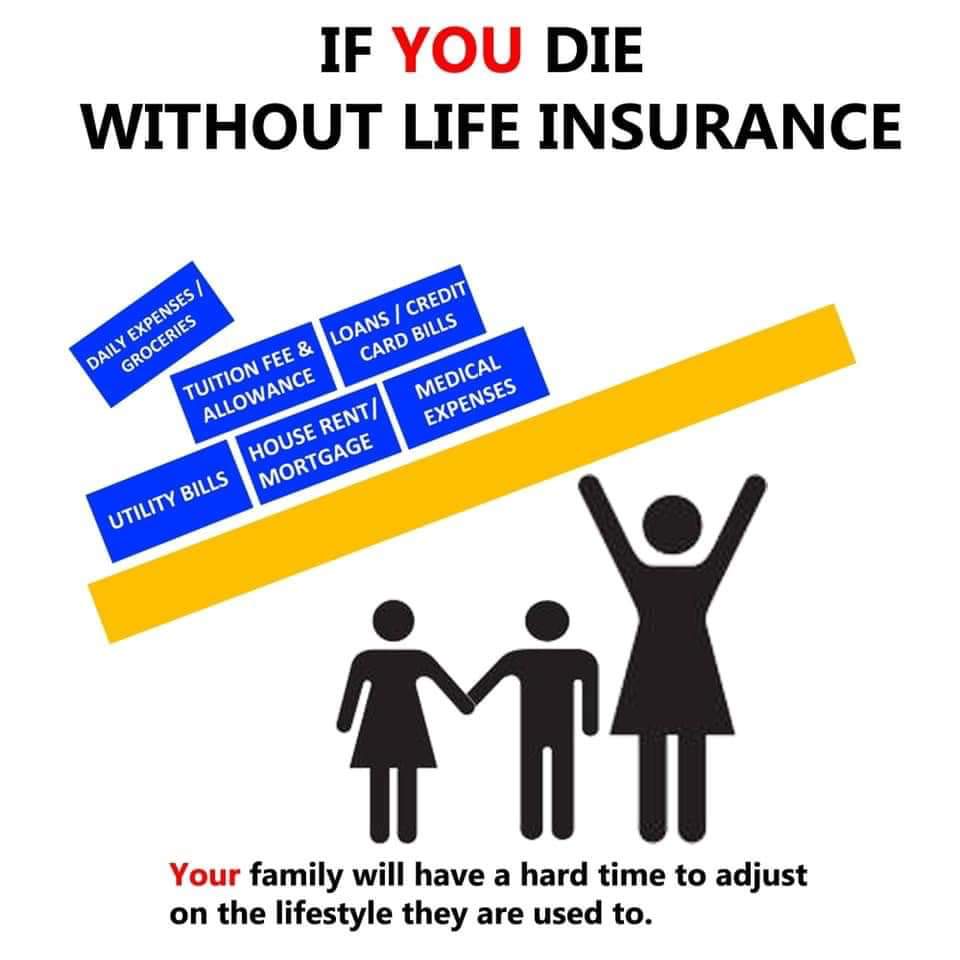

Life insurance, in its essence, is a financial safety net designed to protect families from the economic repercussions of the death of a breadwinner. It provides a crucial financial buffer, ensuring that loved ones are shielded from debt, financial strain, and potential hardship during a difficult time. This protection extends beyond immediate financial needs, enabling families to maintain their living standards, pay off debts, fund children’s education, and pursue future aspirations without being burdened by the loss of a primary income source.

The concept of life insurance has been around for centuries, with its roots tracing back to ancient societies where groups would pool resources to protect each other from financial distress upon the death of a member. Over time, the concept evolved into formalized insurance policies, offering individuals and families a structured means to secure their financial well-being in the event of an unforeseen loss. Today, life insurance plays a vital role in modern society, serving as a cornerstone of financial planning for millions of families around the globe.

This article delves deeper into the importance of life insurance for family protection, exploring strategies and considerations that can empower individuals to make informed decisions about their financial security and ensure a solid foundation for their families’ future.

FAQs about “Importance of life insurance for family protection”

This section addresses common questions and concerns surrounding the importance of life insurance for family protection.

Question 1: Why is life insurance considered essential for family protection?

Life insurance is considered essential for family protection because it provides a financial cushion to help families cope with the financial consequences of the loss of a breadwinner. Without life insurance, surviving family members could be left with substantial debt, lost income, and the burden of managing household expenses without the primary income source.

Question 2: What are the different types of life insurance, and how do they differ?

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Permanent life insurance, such as whole life insurance or universal life insurance, offers lifelong coverage and builds cash value over time. The choice between term and permanent life insurance depends on individual needs and financial goals.

Question 3: How much life insurance coverage is needed for my family?

The amount of life insurance coverage needed depends on factors such as outstanding debts, dependents’ ages, living expenses, and desired lifestyle. A common rule of thumb is to aim for coverage that is 10-15 times your annual income. However, it is highly advisable to consult with a financial advisor to determine the optimal amount of coverage for your specific situation.

Question 4: What are the benefits of having life insurance?

The benefits of having life insurance extend beyond financial security. It provides peace of mind, knowing that your family is financially protected in the event of your passing. It also allows families to maintain their living standards, pay off debts, fund children’s education, and pursue future aspirations without being burdened by financial constraints.

Question 5: What factors should I consider when choosing a life insurance policy?

When choosing a life insurance policy, factors to consider include the type of coverage (term or permanent), the premium amount, the death benefit, the policy’s features, and the financial stability of the insurance company. It is essential to thoroughly research and compare options before making a decision.

Question 6: Is life insurance expensive?

The cost of life insurance varies depending on factors such as age, health, lifestyle, and coverage amount. It is important to explore different options and compare premiums before making a decision. It is also important to remember that the investment in life insurance can provide invaluable protection for your family’s financial future.

In summary, understanding the different types of life insurance, considering factors like age, health, and coverage amount, and seeking professional advice can ensure that you choose a policy that best meets your family’s needs and provides the financial protection they deserve.

Tips for “Importance of life insurance for family protection”

This section offers practical tips to help you navigate the process of obtaining life insurance for your family.

Tip 1: Assess your family’s needs. Before purchasing life insurance, carefully consider your family’s financial situation, including existing debts, living expenses, and the age of your dependents. This assessment will help you determine the appropriate level of coverage needed.

Tip 2: Compare different life insurance policies. Research different insurance companies and compare their policies, premiums, coverage options, and financial stability. It is essential to find a policy that best suits your family’s needs and budget.

Tip 3: Seek professional advice. Consult with a qualified financial advisor to gain personalized insights and guidance on choosing the right life insurance policy. They can help you determine the appropriate coverage amount, explore different options, and ensure that your policy aligns with your financial goals.

Tip 4: Review your policy periodically. Your family’s needs may change over time, so it is essential to review your life insurance policy regularly to ensure it remains aligned with your financial goals and continues to provide adequate protection for your loved ones.

Tip 5: Consider adding riders. Life insurance policies often offer optional riders that can enhance your coverage, such as accidental death benefits, disability income protection, or critical illness coverage. Explore these riders to customize your policy and address specific needs.

Tip 6: Maintain your policy. Once you have a life insurance policy, it is crucial to maintain it by paying premiums on time. Failing to do so could result in policy lapse, leaving your family without coverage.

By following these tips, you can navigate the process of obtaining and maintaining life insurance for your family with confidence, ensuring that your loved ones are financially protected in the event of your passing.

Conclusion on “Importance of life insurance for family protection”

Life insurance plays a vital role in ensuring the financial security and well-being of families. It provides a financial safety net, protecting loved ones from the economic repercussions of the death of a breadwinner. By providing a death benefit, life insurance enables families to pay off debts, maintain their living standards, fund children’s education, and pursue their future aspirations without financial hardship.

Making informed decisions about life insurance requires careful consideration of various factors, including your family’s needs, financial goals, and available options. Seeking professional advice from a financial advisor can empower you to make choices that align with your financial well-being and provide the necessary protection for your family’s future.

“`

Published on: 2024-10-12 08:00:40