Top Strategies for Tips for getting cheap and quality car insurance in 2024

“`html

Best Tips on Tips for getting cheap and quality car insurance for Beginners

Best Tips on Tips for getting cheap and quality car insurance for Beginners

Finding affordable and comprehensive car insurance, particularly for new drivers, can seem like a daunting task. The market is saturated with numerous options, each offering different coverage, discounts, and price points. This can lead to confusion and uncertainty, especially when navigating the complex world of insurance terms and policies for the first time.

Understanding the importance of car insurance is paramount. It serves as a financial safety net, protecting individuals and their assets in the event of an accident or other covered incidents. It can help cover expenses related to repairs, medical bills, and legal costs, preventing significant financial hardship. Historically, car insurance has evolved alongside the increasing complexities of the automobile industry and the rise of traffic accidents, becoming a vital component of responsible vehicle ownership.

This article aims to provide a comprehensive guide to effectively navigating the car insurance landscape, empowering new drivers to make informed decisions and secure the best possible coverage at a reasonable price.

FAQs about Tips for getting cheap and quality car insurance

This section addresses common questions and concerns related to securing affordable and quality car insurance.

Question 1: What factors influence the cost of car insurance?

The price of car insurance is determined by a multitude of factors, including the driver’s age, driving history, vehicle type, location, and coverage levels. Younger drivers, those with poor driving records, and residents of high-risk areas often face higher premiums. The type and value of the vehicle also impact costs, with luxury or high-performance cars typically requiring greater coverage.

Question 2: What are the essential types of car insurance coverage?

While specific coverage options may vary by state, there are several core types of car insurance commonly included in policies. These include:

- Liability Coverage: This protects the policyholder against financial liability if they are found at fault in an accident. It covers injuries to other drivers, passengers, or pedestrians, as well as damage to their vehicles.

- Collision Coverage: This pays for repairs or replacement of the insured vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to the insured vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects the policyholder if they are involved in an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage, often mandated in certain states, covers medical expenses and lost wages for the insured and passengers in the event of an accident, regardless of fault.

Question 3: What are some common car insurance discounts?

Many insurers offer discounts to reduce premiums. These discounts can be based on various factors:

- Good Driver Discounts: Drivers with clean driving records often receive lower premiums.

- Safe Driver Discounts: Installing safety features such as anti-theft devices or anti-lock brakes can result in a discount.

- Multi-Car Discounts: Insuring multiple vehicles with the same company can lead to a lower combined premium.

- Multi-Policy Discounts: Bundling car insurance with other types of insurance, such as homeowners or renters insurance, can result in savings.

- Good Student Discounts: Some insurers offer discounts to students with good grades.

- Driver Training Discounts: Completing defensive driving courses can often lead to a discount.

Question 4: Is it possible to switch insurance providers?

Yes, drivers can switch insurance providers at any time. When switching, it’s essential to carefully compare quotes from different insurers and consider factors such as coverage levels, discounts, and customer service reputation. It’s also important to ensure that any new policy provides adequate coverage for your specific needs.

Question 5: What are some common insurance claims procedures?

In the event of an accident or other covered incident, it’s important to promptly report the claim to your insurer. The process often involves:

- Contacting the insurance company: Report the incident and provide detailed information about the circumstances.

- Filing a claim: Provide any necessary documentation, such as a police report or medical records.

- Cooperating with the insurer: Provide all required information and respond to any inquiries.

Question 6: What is the role of an insurance agent?

Insurance agents act as intermediaries between individuals and insurance companies. They can help explain coverage options, assess individual needs, compare policies, and handle claims processing. They can be valuable resources for individuals seeking guidance in navigating the complexities of car insurance.

Understanding these FAQs provides a solid foundation for making informed decisions regarding car insurance.

Tips for Tips for getting cheap and quality car insurance

This section provides practical tips for securing affordable and comprehensive car insurance:

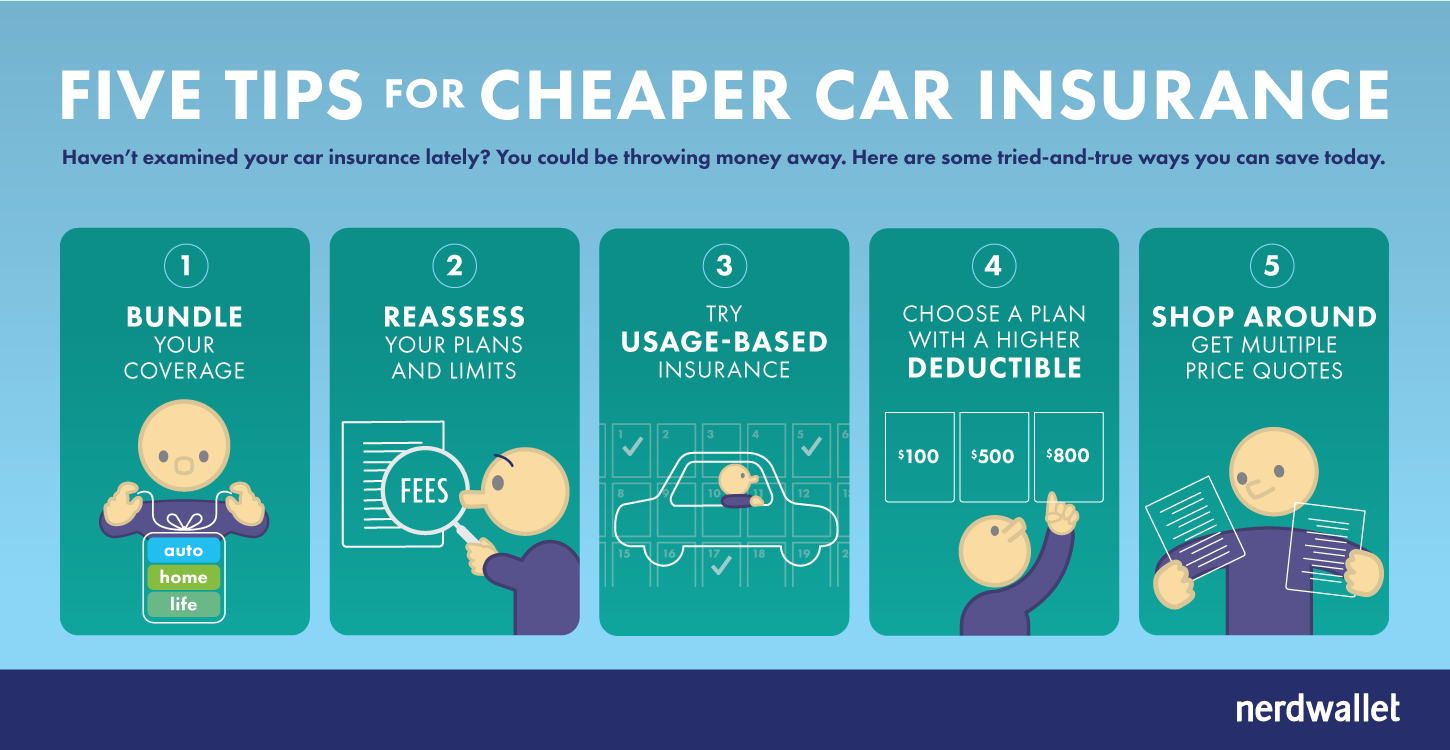

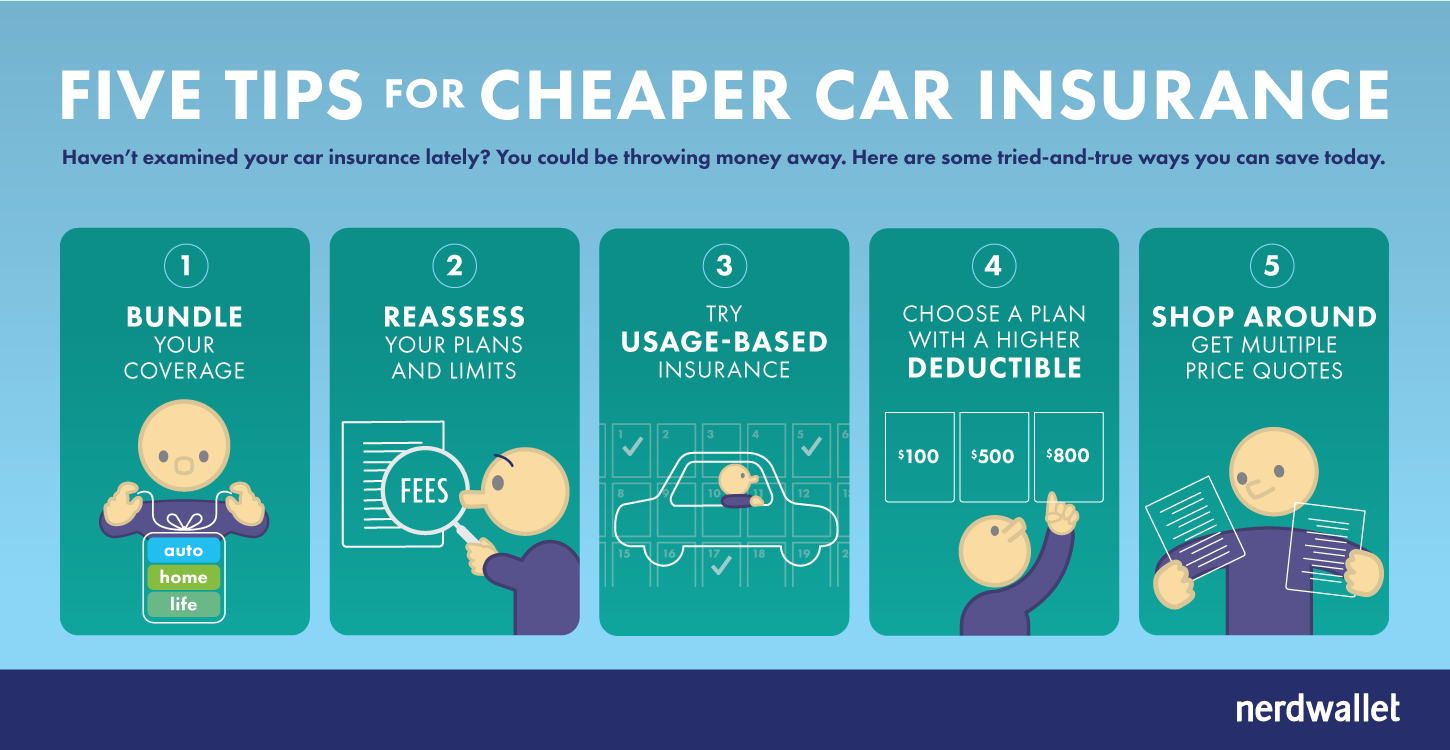

Tip 1: Compare Quotes from Multiple Insurers:

Don’t settle for the first quote you receive. Obtain quotes from several reputable insurance companies, comparing coverage levels, discounts, and overall price. Online comparison tools and websites can make this process more efficient.

Tip 2: Consider Your Coverage Needs:

Carefully evaluate your individual needs and circumstances. Determine the minimum coverage required by your state and assess additional coverage options based on factors such as the value of your vehicle, driving habits, and financial situation.

Tip 3: Explore Available Discounts:

Inquire about discounts offered by each insurer. Some common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, good student discounts, and driver training discounts. Taking advantage of eligible discounts can significantly reduce your premium.

Tip 4: Consider Increasing Your Deductible:

A higher deductible means you pay more out of pocket in case of an accident but often results in lower premiums. This can be a cost-effective option for individuals with a strong financial buffer and a lower risk tolerance for accidents.

Tip 5: Improve Your Driving Record:

Maintaining a clean driving record is one of the most effective ways to lower your premium. Avoid traffic violations, such as speeding tickets or accidents, and practice safe driving habits.

Tip 6: Bundle Your Insurance Policies:

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant discounts. This strategy can be particularly advantageous for individuals who already have multiple insurance policies.

Tip 7: Consider a Higher Credit Score:

While not a universal practice, some insurance companies may factor credit score into their pricing models. Maintaining a good credit score can potentially lead to lower premiums in these situations.

Tip 8: Review Your Policy Periodically:

It’s essential to review your insurance policy annually or whenever your circumstances change. This ensures that your coverage remains adequate and that you are taking advantage of all available discounts.

By applying these tips, you can effectively navigate the car insurance landscape and secure the best possible coverage at a reasonable price.

Conclusion on Tips for getting cheap and quality car insurance

Navigating the world of car insurance can be a complex process, especially for new drivers. Understanding the factors that influence premiums, available coverage options, and common discounts is crucial to making informed decisions. By comparing quotes from multiple insurers, carefully considering coverage needs, and implementing strategies to improve driving habits and credit score, individuals can secure affordable and comprehensive car insurance that meets their individual requirements.

Remember that car insurance is an investment in financial protection. By taking the time to understand the options and make responsible choices, you can ensure peace of mind knowing that you are adequately covered in the event of an unexpected incident.

“`

Published on: 2024-10-12 21:25:01

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas