Best Tips on Comprehensive insurance coverage for luxury cars in 2025

“`html

Essential Advice for Comprehensive Insurance Coverage for Luxury Cars You Need to Know

Essential Advice for Comprehensive Insurance Coverage for Luxury Cars You Need to Know

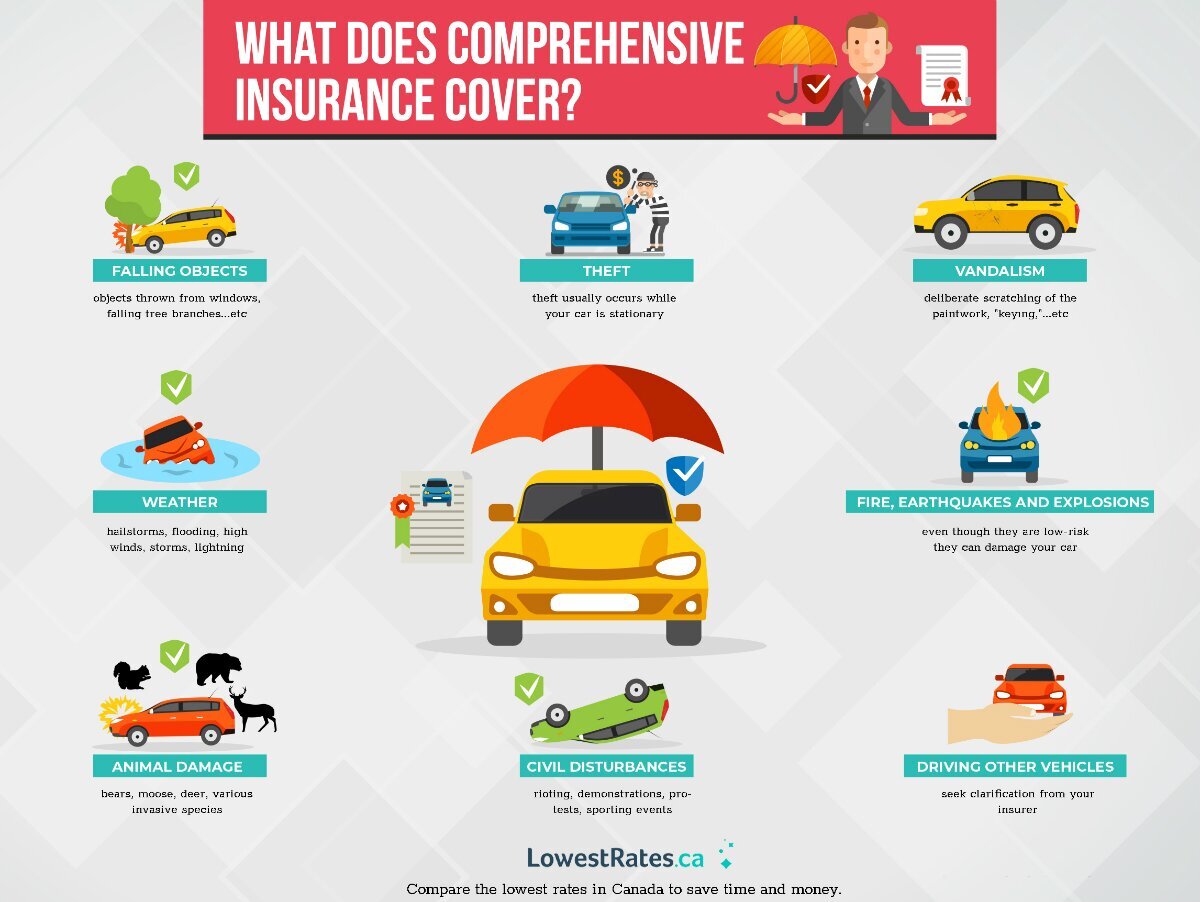

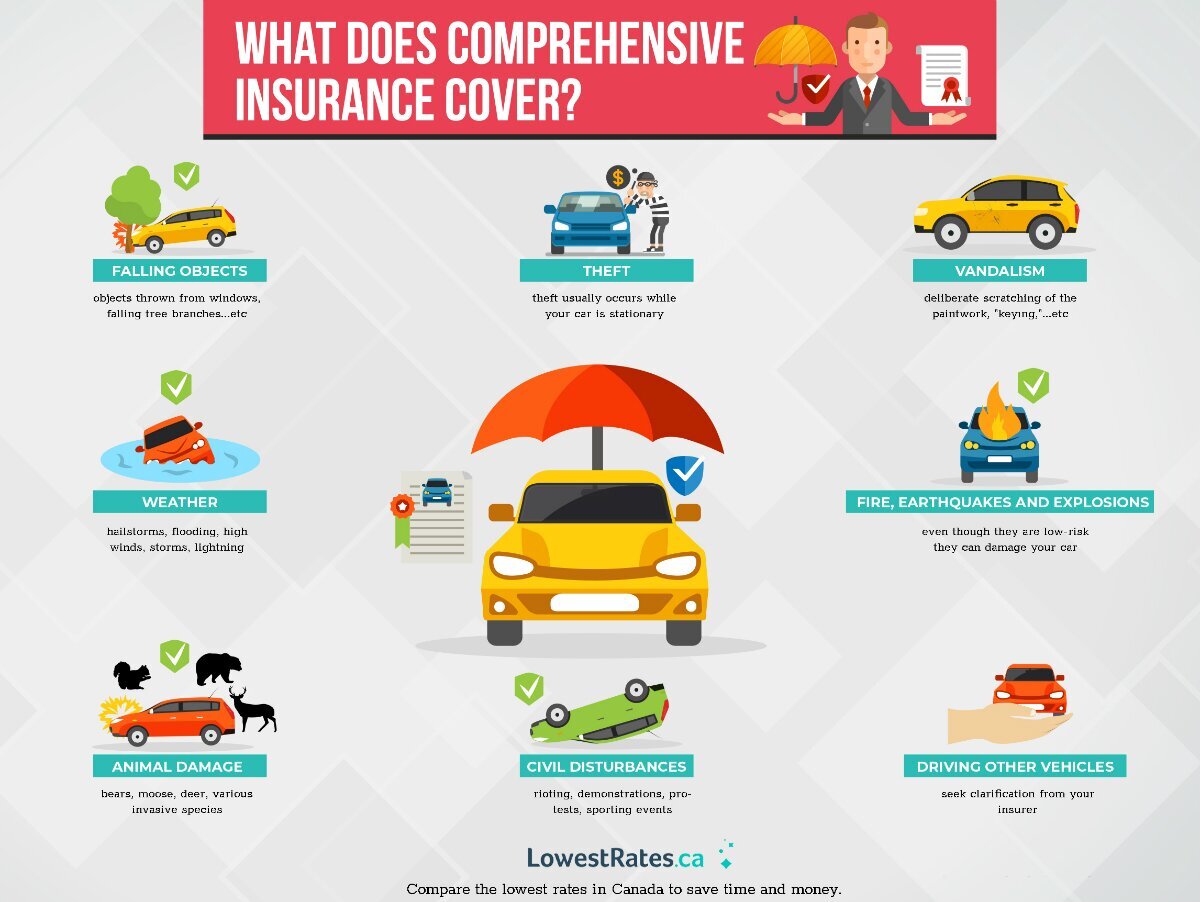

Comprehensive insurance coverage for luxury cars is a vital component of protecting your valuable investment. It goes beyond basic liability coverage, providing financial protection against a wide range of risks that can damage your car, from accidents and theft to natural disasters and vandalism. While traditional car insurance policies might suffice for standard vehicles, luxury cars, often possessing unique features, high performance capabilities, and substantial monetary value, necessitate a more comprehensive approach to ensure adequate coverage.

This type of insurance is essential for owners of luxury cars as it safeguards against substantial financial losses. Imagine your prized automobile being stolen, damaged in a hailstorm, or encountering a costly mechanical failure. Comprehensive insurance ensures that you can repair or replace your vehicle, restoring its functionality and preserving its value. Moreover, historical context underscores the importance of comprehensive coverage for luxury cars, as these vehicles have traditionally been targets for theft and vandalism due to their desirability and resale value. The increasing sophistication of these automobiles, with advanced technology and intricate components, further necessitates a comprehensive insurance policy to address potential repair costs.

This article will delve deeper into the complexities of comprehensive insurance coverage for luxury cars, providing insightful advice and key considerations for securing the right protection. We’ll explore frequently asked questions, uncover valuable tips for optimizing coverage, and ultimately offer a comprehensive conclusion emphasizing the importance of this crucial protection for luxury car owners.

FAQs about Comprehensive Insurance Coverage for Luxury Cars

Navigating the intricacies of comprehensive insurance coverage for luxury cars can be daunting. Here are some frequently asked questions to illuminate the process and address common concerns:

Question 1: What are the key differences between comprehensive insurance coverage and standard car insurance?

While standard car insurance typically includes liability coverage, comprehensive insurance extends its protection to cover a wider range of perils. It safeguards against losses arising from theft, vandalism, fire, natural disasters, and other non-accident related events. It also often includes coverage for collision damage, which standard car insurance might not encompass.

Question 2: How do I determine the appropriate coverage limits for my luxury car?

Determining the ideal coverage limits depends on several factors, including the market value of your car, its age, condition, and any unique modifications. It’s crucial to consider both the cost of repair or replacement and potential deductibles. Consult with your insurance agent to discuss your specific needs and tailor coverage accordingly.

Question 3: What factors influence the cost of comprehensive insurance for luxury cars?

The cost of comprehensive insurance for luxury cars is influenced by a multitude of factors, including the make, model, year, and value of the vehicle. Your driving history, location, and insurance company all play a role. Higher-end cars with specialized components, advanced technology, and a higher resale value generally attract higher premiums.

Question 4: What are the advantages of opting for a dedicated luxury car insurance provider?

Dedicated luxury car insurance providers offer specialized expertise in handling the intricacies of insuring high-value vehicles. They possess a deep understanding of the nuances of luxury car models, potential repair costs, and specialized coverage options. They also often provide concierge-level services, simplifying the claims process and addressing unique needs.

Question 5: What are some common misconceptions about comprehensive insurance for luxury cars?

One common misconception is that comprehensive insurance for luxury cars is too expensive. While premiums might be higher than for standard vehicles, the peace of mind it provides outweighs the cost. Another misconception is that it only covers damage from accidents. Comprehensive insurance extends its protection to a broader range of risks, offering a more comprehensive safety net.

Question 6: Is comprehensive insurance mandatory for luxury cars?

Comprehensive insurance is generally not mandated by law, but it’s highly recommended for luxury car owners. While standard car insurance fulfills basic legal requirements, comprehensive coverage offers a significantly higher level of protection against financial losses. It provides peace of mind knowing that your valuable investment is adequately insured against unforeseen circumstances.

In summary, understanding the nuances of comprehensive insurance for luxury cars empowers you to make informed decisions. It’s essential to consider your specific needs, vehicle characteristics, and available options to ensure adequate protection for your valuable asset.

Tips for Comprehensive Insurance Coverage for Luxury Cars

Securing the right comprehensive insurance coverage for your luxury car involves more than simply selecting a policy. These tips will guide you towards a well-informed decision and optimized protection:

Tip 1: Compare quotes from multiple insurance providers.

Different insurance companies offer varying rates and coverage options. Compare quotes from several providers to find the best value for your needs. Consider factors like coverage limits, deductibles, and the provider’s reputation for handling claims efficiently.

Tip 2: Research specialized luxury car insurance providers.

Dedicated luxury car insurance providers often offer tailored policies and comprehensive coverage options designed for high-value vehicles. Their expertise in handling the complexities of insuring luxury cars can be invaluable.

Tip 3: Consider the value of your luxury car.

Ensure your coverage limits are sufficient to cover the full replacement cost of your car, taking into account its current market value and any unique modifications. Consult with your insurance agent to determine the appropriate coverage limits for your specific vehicle.

Tip 4: Assess your driving history and risk factors.

Your driving history, location, and other risk factors play a role in determining your premium. Good driving habits, safe parking locations, and a clean driving record can often result in lower rates.

Tip 5: Understand the terms and conditions of your policy.

Before signing any policy, thoroughly review the terms and conditions, paying attention to coverage limits, deductibles, exclusions, and claim procedures. Understanding these details ensures you are aware of the scope of your protection.

Tip 6: Ask about additional coverage options.

Luxury cars often require specialized coverage, such as coverage for custom modifications, replacement parts, or specific driving conditions. Explore additional coverage options that address your unique needs and protect your investment.

Tip 7: Maintain a clean driving record and safe driving habits.

Good driving habits and a clean driving record can significantly impact your premiums. Avoid speeding, driving under the influence, and other risky behaviors to maintain a favorable driving history.

By following these tips, you can navigate the complexities of comprehensive insurance coverage for luxury cars and secure the right protection for your valuable investment.

Conclusion on Comprehensive Insurance Coverage for Luxury Cars

Comprehensive insurance coverage for luxury cars serves as a crucial safeguard for your valuable investment. This article explored the importance of this type of coverage, addressing key aspects like its role in protecting against a wide range of risks, the factors influencing its cost, and common misconceptions. It also provided essential tips for optimizing coverage, highlighting the value of comparing quotes, researching specialized providers, and understanding the nuances of your chosen policy.

While comprehensive insurance coverage for luxury cars may seem like an additional expense, its importance cannot be overstated. It offers peace of mind knowing that your prized possession is protected against unforeseen circumstances. By carefully considering your needs, researching available options, and engaging with your insurance provider, you can ensure your luxury car is adequately insured, allowing you to enjoy the thrill of driving knowing that your investment is secure.

“`

Published on: 2024-10-12 19:41:29