Best Tips on Unsecured Personal Loans with Fast Processing for Beginners

Best Tips on Unsecured Personal Loans with Fast Processing for Beginners

In today’s fast-paced world, financial emergencies can arise unexpectedly. When you need money quickly, an unsecured personal loan with fast processing can be a valuable solution. But navigating the world of personal loans can be daunting, especially for beginners. This guide aims to demystify this process, providing essential information and actionable tips to help you make informed decisions.

Understanding Unsecured Personal Loans with Fast Processing

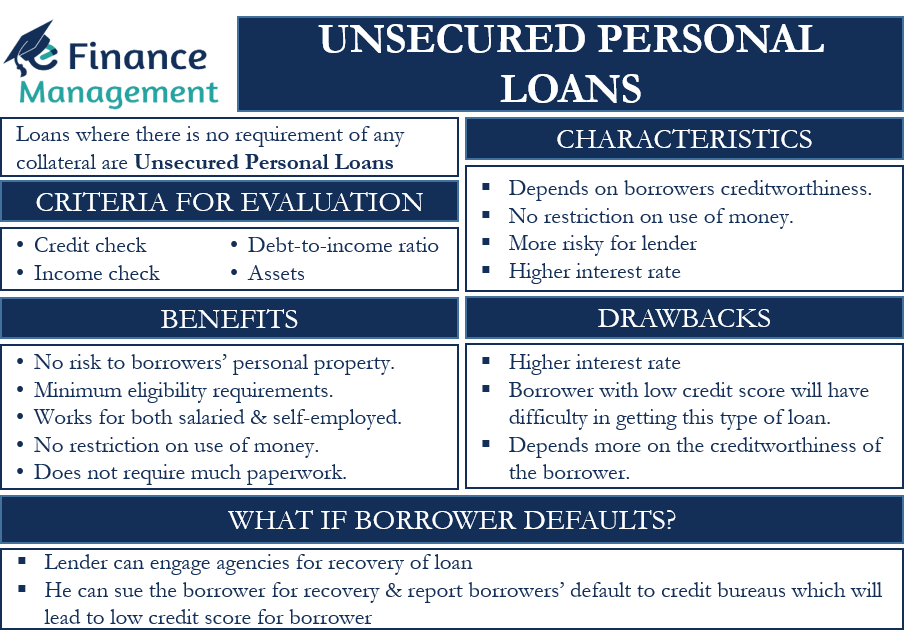

Unsecured personal loans, as the name suggests, are not backed by any collateral. This means the lender is taking a greater risk, and as a result, interest rates are typically higher compared to secured loans. However, the convenience and speed of these loans make them a popular choice for borrowers in urgent need of funds.

Fast processing usually means you can get the money within a few days, or sometimes even within hours, depending on the lender and your specific circumstances. This expedited process is achieved through streamlined application processes and automated approval systems.

FAQs about Unsecured Personal Loans with Fast Processing

Here are some frequently asked questions about unsecured personal loans with fast processing:

What are the eligibility requirements for unsecured personal loans?

Eligibility criteria for unsecured personal loans can vary from lender to lender, but typically include:

- Good credit score (typically 670 or above)

- Stable income and employment history

- U.S. citizenship or permanent residency

- Age requirement (usually 18 years or older)

- Valid bank account

What is the typical interest rate for unsecured personal loans?

Interest rates for unsecured personal loans are usually higher than secured loans, reflecting the increased risk for the lender. Rates can range from 5% to 36% or even higher, depending on your credit score, loan amount, and other factors.

How long does it take to get approved for an unsecured personal loan?

With fast processing, you can often get approved for an unsecured personal loan within a few days or even hours. However, some lenders might require additional documentation or verification, which can extend the approval timeframe.

What are the different types of unsecured personal loans?

Unsecured personal loans can be categorized into various types, including:

- Traditional personal loans: These are the most common type, typically offered by banks, credit unions, and online lenders.

- Peer-to-peer loans: These loans are funded by individuals through online platforms, allowing for competitive interest rates and flexible terms.

- Payday loans: These are short-term, high-interest loans designed for quick cash advances, often with a high APR. Be cautious with payday loans, as they can lead to a cycle of debt.

Tips for Securing an Unsecured Personal Loan with Fast Processing

Here are some tips for maximizing your chances of getting an unsecured personal loan with fast processing:

1. Check Your Credit Score

Before applying for any loan, it’s crucial to know your credit score. A good credit score (typically 670 or above) significantly improves your chances of approval and can lead to lower interest rates. You can get your credit score for free from various sources, including Credit Karma, Experian, and TransUnion.

2. Shop Around for the Best Rates

Don’t settle for the first loan offer you receive. Take the time to compare offers from different lenders to find the best interest rates and terms. Online loan comparison platforms can streamline this process, making it easier to find competitive options.

3. Gather Required Documents

Lenders typically require various documents to verify your identity, income, and employment history. These documents might include:

- Photo identification

- Proof of income (pay stubs, tax returns, bank statements)

- Social Security number

- Bank account information

4. Consider Pre-approval

Some lenders offer pre-approval options, which provide an indication of your eligibility without impacting your credit score. This process can give you a better understanding of your potential loan terms and interest rates before submitting a formal application.

5. Be Realistic about Loan Amounts

Borrow only what you can afford to repay. Consider your monthly budget and income when determining the loan amount to avoid overwhelming yourself with debt payments.

6. Understand the Terms and Conditions

Carefully review the loan agreement before signing. Pay attention to interest rates, fees, repayment terms, and any other conditions that may affect your loan. Don’t hesitate to ask questions if you have any doubts or concerns.

Conclusion

Unsecured personal loans with fast processing can be a valuable option for borrowers facing urgent financial needs. By understanding the process, shopping around for the best rates, and following these tips, you can increase your chances of getting approved and securing the funds you require. Remember to borrow responsibly and ensure you can comfortably repay the loan to avoid any future financial strain.

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas

Kamarblogger Informasi seputar Sosial Media, Aplikasi Android, Info Forex dan Harga Emas